Paid for by gradually transferring livestock subsidies

The following breakdown is written in conjunction with our Transfer Livestock Subsidies to Native Animal & Habitat Restoration Projects Petition.

More Than $30 billion Per Year:

The U.S. Department of Agriculture (USDA) spends more than $25 billion annually on subsidies for farm businesses, with most of these agricultural subsidies going to farmers of wheat, corn, soybeans, rice, & cotton. Roughly a million farmers and landowners receive federal subsidies, but the payments are heavily tilted toward the largest producers. [1]

According to the Cato Institute, upwards of $30 billion taxpayer dollars per year are funneled into cash subsides to farmers and owners of farmland each year. Seventy-two percent goes to the ten largest subsidized farms, effectively countering the original New Deal intention of supporting small family farmers.

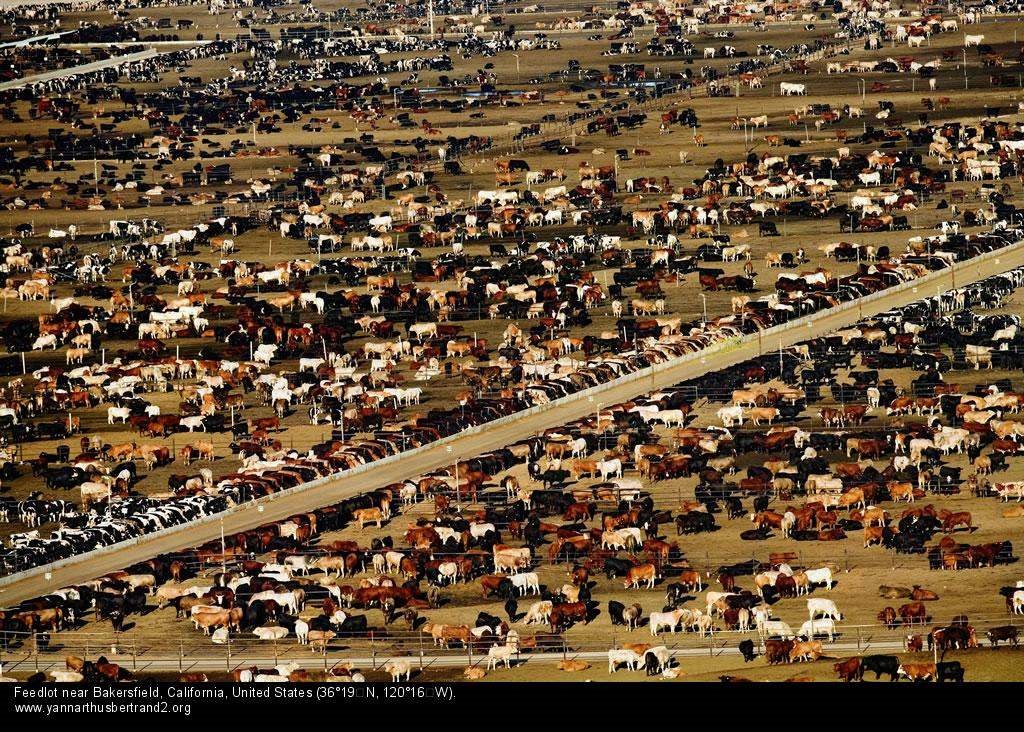

In the meat industry, subsidized feed grain (i.e. “field corn“) has significantly altered the cow-calf industry. Cheap feed grain encourages concentrated feedlot systems. 500,000 head of cattle in one feed yard is not unheard of today. [2]

Click to Enlarge:

Above photo of a Bakersfield, CA area feedlot posted by KüreLee. Feedlots such as this are typical throughout the U.S.

Eight Types of Farm Subsidies:

Note: The Conservation Reserve Program & similar conservation programs which collectively cost ~5 billion per year are not included, as they pay farmers to keep their lands out of production.

1.) Insurance – Crop insurance run by the USDA’s Risk Management Agency is the largest farm program with annual outlays of about $8 billion. [3] Subsidized insurance protects against various business risks- adverse weather, low production, & low revenues. It covers more than 100 crops including feed crops for livestock – corn, cotton, soybeans, & wheat are the main ones. It subsidizes both insurance premiums and administrative costs of the 19 private insurance companies that offer policies to farmers. [4]

2. Agricultural Risk Coverage (ARC) – This program pays subsidies to farmers if their revenue per acre (or county’s revenue per acre) falls below a guaranteed level. Generally, the lower are prices & revenues, the larger the subsidies paid. More than 20 crops are covered, from wheat and corn to chickpeas and mustard. ARC subsidies fluctuate, but were around $7 billion in 2016.

3. Price Loss Coverage (PLC) – Pays farmers based on the average national price of each particular crop compared to the crop’s reference price. The larger the fall in a crop’s price below its reference price, the larger the payout to farmers. PLC subsidies cover more than 20 crops. PLC subsidies were about $2 billion in 2016. [5]

4. Marketing Loans – This is a price guarantee program that began in the New Deal era. The original idea was to give farmers a loan at harvest time so that they could hold their crops to sell at a higher price later on. But the program has evolved into just another subsidy program that delivers higher payments to farmers when market prices are low. These subsidies will cost about $400 million in 2016.

5. Disaster Aid – The government operates various disaster aid programs for different types of farmers, from wheat growers, to livestock producers, to orchard operators. In addition to permanent disaster programs, Congress sometimes distributes additional aid after adverse events. Disaster and supplemental aid costs about $1 to $2 billion a year.

6. Marketing and Export Promotion – The Agriculture Marketing Service spends about $1.2 billion a year on farm and food promotion activities. The Foreign Agricultural Service spends about $1.4 billion a year on a range of activities, including marketing U.S. farm and food products abroad through 93 foreign offices.

7. Research and Other Support – Most American industries fund their own research and development, but the government employs thousands of scientists and other experts to aid the agriculture industry. The USDA spends about $3 billion a year on agriculture and food research at more than 100 locations. The department also provides other support services, such as statistical information and economic studies. [1]

References:

[1]: Downsizing the Federal Government, “Agricultural Subsidies” by Chris Edwards. October 7, 2016: www.downsizinggovernment.org/agriculture/subsidies

[2]: Property and Environment Research Center (“PERC”), “BIG MEAT” AND BIG GOVERNMENT – SUBSIDIES AND REGS ARE THE CULPRITS” by Paul Schwennesen: www.perc.org/articles/big-meat-and-big-government

[3]: Budget of the United States Government, Fiscal Year 2017, Analytical Perspectives(Washington: Government Printing Office, 2016), Table 29-1.

[4]: Government Accountability Office, “Crop Insurance: Reducing Subsidies for Highest Income Participants Could Save Federal Dollars with Minimal Effect on the Program,” GAO-15-356, March 2015.

[5]: USDA’s Economic Research Service, “Government payments by program”: https://data.ers.usda.gov/reports.aspx?ID=17833

*************************************

Back to The Platform:

Petition – Transfer Livestock Subsidies to Native Animal & Habitat Restoration Projects – Bison, Elk, Antelope, etc.

Related Topics:

- Destroying Ecosystems & Poisoning Waterways – The Devastating Ecological Impacts of Livestock Industries

- Animal Abuse & Subjugation in the Current U.S. Economy

- Habitat Restoration Processes & Organizations Involved

*************************************